There are dozens of investment apps available in mobile app stores with features such as robo-advisors, stock trading, options trading, crypto trading, and more. Selecting the best of the best investment apps can be challenging.

It only takes a few swipes with today’s best investment apps to get started. In fact, you can get a personalized portfolio setup or trade your stocks in a few minutes. Furthermore, you can track your assets and move money around without any human intervention.

After missing out on the recent WallStreetBets (WSB) saga, I did some research to find the best applications for managing and investing your money. All of these applications are excellent for newbies. Hopefully, I can partake in the next market WSB uprising.

Let’s get started.

Quick Review

Without wasting your time, below are the best investment app.

- Acorns: My overall best investment app

- M1 Finance: Best for setting investment goals

- Robinhood: Best investment app for low fees

- Fidelity: Best investment app for hands-off investors

- SoFi: Best for diversified investing

- Webull: Best for college students

Best Investment Apps

If you need more details, the best investment apps have been reviewed below:

1. Acorns

This investment app has combined the Robo-advisor framework with an automatic savings tool to modernize the old-fashioned idea of saving spare change.

Acorns take care of the rest after you link your credit card and checking account. Unless you’re just paying pennies at a time, this micro-savings software makes investing almost effortless.

Since this overall investment experience can be generated and controlled from a smartphone, the Acorns app is aimed at a much younger, more tech-savvy demographic. They just released a web-based version for desktop and mobile users.

Essentially, this app is an excellent place to start for anybody who hasn’t invested yet or wants some help getting started.

While micro-savings remain Acorns’ primary focus, the company does more than merely invest your leftover cash. Among other things, you can save for retirement, open a checking account, and open a custodial investment account for your children.

Acorns started as an app, but it now has a web-based version for desktop and mobile users. Acorns stands out among the most popular financial apps with its pleasant green interface that makes you feel at ease as soon as you open it.

It’s simple to review your prior investments and create new ones from inside the mobile app. Acorns reads your credit card spending habits and rounds each transaction up to the next whole amount when you link your credit card and checking account.

It takes the difference between your checking and savings accounts and invests it in an Acorns account you create. The customer support at Acorns isn’t as good as it is at other investment firms.

Pros

- If you have any spare cash, Acorns will be automatically invest for you

- Acorns do not have a minimum deposit required to begin utilizing their service

- There are educational materials accessible

- Cashback at a few stores

- Since the sums taken out of your account are modest, you will not notice that they have disappeared from your checking account

Cons

- Acorns charge a high fee on lower account balances

- An investment portfolio with a limited size

- No live chat support.

- Phone hours are limited to 6:00 a.m to 7:00 p.m PST.

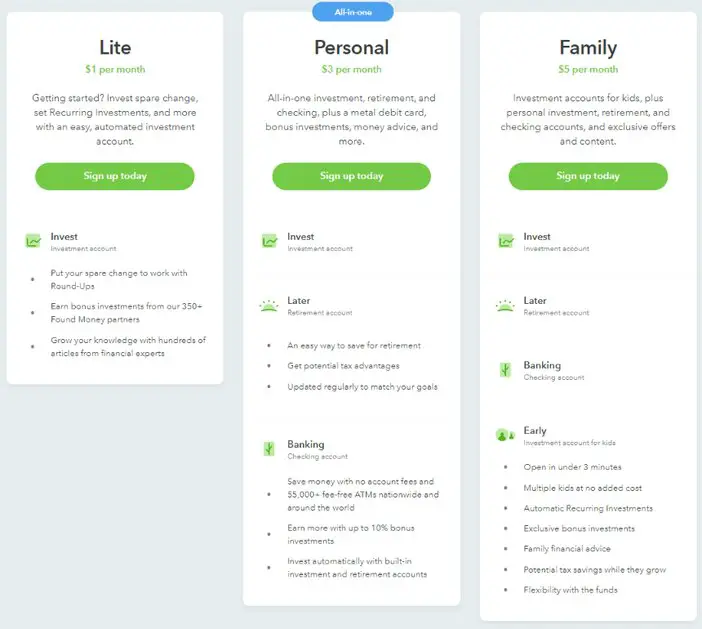

Pricing

The cost structure of Acorn is as simple as it gets, with three tiers: Lite, Personal, and Family.

The Lite premium service costs $1 per month and is designed for those looking to invest little amounts of money.

The Personal account costs $3 a month and includes both an investing and a retirement account to help you concentrate on long-term investment goals you can enjoy later in life. Personal account holders have a bank account as well, which is convenient if you want to keep all of your finances in one place.

For $5 per month, you can help your children safeguard their financial future by opening a Family account. It’s a fantastic approach to get their finances moving in the right direction, and it’s why we think Acorns is one of the best investment apps for families.

2. M1 Finance

M1 Finance was founded by Brian Barnes, who began investing at an early age. Barnes noticed over time that there weren’t enough automated resources for duties like advising, automated deposits, and asset development.

He wanted to create an investment environment where clients could have their investments run on autopilot.

M1 Finance, as a robo adviser and money management resource, allows investors to automate activities while maintaining total management over their funds.

It may seem implausible, given that nothing comes for free, but every M1 Finance user review will tell you that the service is free to use and that there are no hidden fees. There is, of course, a paid option for individuals who want greater access than the free membership provides.

M1 Finance’s key advantage over most robo-advisors is that it does not charge any asset management fees. Most robo-advisors charge 0.25% as a reference.

While the robo-advisor offers a variety of different services, their investment service is by far their most popular. How does M1 Finance make money now that you know it’s free and offers a premium tier option?

Typically, the business makes money by collecting interest on the loans it provides to its customers. M1 Finance also lends out the securities that its customers buy to other investors, who profit from the loans as well.

Just like many of the best investment apps, M1 Finance provides new clients discounts. You’ll get a $30 bonus if you deposit $1,000 or more into your account. Those who move their stocks from another broker to M1 Finance can earn a reward of up to $2,500.

Pros

- M1 Finance does not charge any commissions or broker fees

- The minimal deposit is low

- You can start investing when your account reaches $100, or you can start with no money at all

- Over 80 professional portfolios are available to view

- Pre-made portfolios that are simple to use and rebalance

- M1 allows you to buy fractional shares for free

- Your cash balance is invested in your portfolio whenever it reaches $10. As a result, your money will always be working for you.

Cons

- Only ETFs and equities are available for purchase through M1 Finance. Stocks and exchange-traded funds (ETFs) are the only investment alternatives

- There is no access to a financial counsel

- The trading window restricts your ability to control investment transactions

- Customer service hours are limited

- M1 does not allow investors to take advantage of tax-loss harvesting. In its place, all investor accounts are subject to a tax avoidance approach

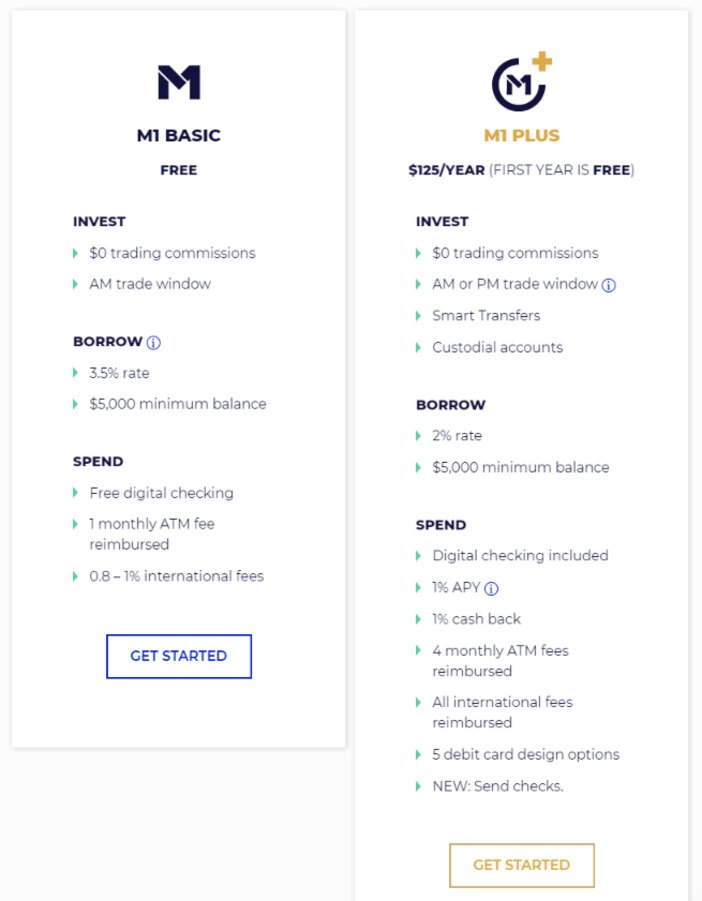

Pricing

You won’t have to worry about administration, commission, or transaction costs with M1 Finance. There are a few fees to be aware of, including the TAF, SEC, inactivity, and wire transfer fees.

Your first year is free, after which you will be charged $125 per year.

You can sign up for the M1 Plus plan if you want some extra goodies like two trading windows, a checking account with a 1% APY, and custodial accounts.

3. Robinhood

While it may not always live up to its moniker, i.e. taking from the wealthy to give to the needy, Robinhood is upsetting up the financial world. It offers both no-fee stock trading and a cash-management account.

Over the last few years, Robinhood has expanded its web presence, expanded its Options Trading services, and launched Robinhood Crypto, which allows you to trade several of the most prominent cryptocurrencies.

In addition, Robinhood has a cash management account where you can earn interest on your money and pay bills using a Mastercard debit card.

You can also get cash for free from over 75,000 ATMs. There are also no transfer fees, account minimums, or international transaction fees. There is currently a waiting list to join the cash management account.

Robinhood is ideal for first-time investors who want to trade small amounts of stock, such as fractional shares and cryptos, and who don’t require to do much more than observe what others are trading.

The app and website are incredibly user-friendly, and the fact that there are no commissions appeals to particularly cost-conscious individuals who trade little amounts.

If you sign up for Robinhood, you’ll get one free stock. This is a random stock from Robinhood’s inventory, with a price range of $2.50 to $10.00.

You can use the Robinhood app to invest in cryptocurrency if that’s something you’re interested in. Cryptocurrency trading has no fees.

Robinhood allows users to trade Ethereum, Bitcoin, Ethereum Classic, Dogecoin, Bitcoin Cash, Litecoin, and Bitcoin SV, making it enticing to anyone looking to get on the crypto bandwagon.

Pros

- ETFs, stocks, cryptocurrencies, and options can all be traded without paying a commission

- Margin investing and fractional shares

- The platform has a dynamic mobile app that is simple to use

- Account creation is quick and completely digital

- There is no minimum account balance requirement

Cons

- Taxable brokerage accounts are the only account kinds available. There are no IRAs or retirement accounts available

- Investing research and trading tools are in short supply

- On the Robinhood platform, you can’t trade mutual funds

- Doesn’t allow users to name beneficiaries or set up automatic transfers in the event of death

Pricing

The fact that Robinhood does not charge commissions is probably the most important factor in its success. This is an amazing solution for you if you are careful with your money.

The Robinhood system allows you to start investing without worrying about losing money due to hidden costs. However, there are certain minor fees that Robinhood passes on to customers, such as FINRA fees.

Signing up for the Gold package, which costs $5 per month, will provide you with a better overall experience. This allows you to deposit between $5,000 and $50,000 quickly, as well as provide you with in-depth stock analysis and level-two market data.

4. Fidelity

Fidelity Investments is known for its mutual funds, but its brokerage arm is no pushover. It offers zero trading costs, a wide range of research, and an easy-to-use interface that can easily be modified for more skilled traders.

This investment app adds value to the client relationship. Fidelity’s website and mobile app both passed my rigorous usability tests with flying colors, earning a perfect five-star grade for Simplicity.

Fidelity’s Active Trader Pro desktop product is ideal for active trading, including day trading, in addition to daily investors.

Whether you’re looking for ETF, stock, or mutual fund quotations or going through a checklist to identify investment ideas, Fidelity excels at research. Investors with IRA assets will be thrilled as well.

Fidelity, as one of the country’s largest brokers, is designed to cater to the vast proportion of individual investors. Fidelity’s all-in-one platform provides the regular buy-and-hold investor with a wealth of information, tools, and resources, as well as quick order entry.

Fidelity offers Active Trader Pro, a downloadable tool with streaming real-time data and a configurable trading interface, for more active investors and full-time traders. It’s important to note that Fidelity doesn’t offer commodities or futures options.

Pros

- There are no account minimums or fees

- A high-quality mobile application

- ETF, stock, and options trades have no commissions, and fractional shares are accessible

- Thousands of no-transaction-fee and fee-free mutual funds are available

- Money market funds are used to invest uninvested funds

- There are a variety of research tools and trading platforms to choose from

Cons

- Investors with larger account balances pay extra for Fidelity Go accounts

- Account verification takes longer

- Trading with a representative is pricey than trades with other brokerages

- Live chat takes a long time

- Non-residents or citizens of the United States are unable to open an account

Pricing

Customers benefit from Fidelity’s $0 stock and ETF trades regularly. If you redeem shares held for fewer than 60 days in any non-Fidelity NTF mutual fund, the business levies a $49.95 fee.

It’s free to get a Fidelity debit card linked to your account, as well as all ATM transactions each month, including overseas ATM withdrawals. The debit card’s only fee is the expense of overseas currency conversion.

Traditional, Roth, SEP, and Rollover IRAs all have no costs. SIMPLE IRAs, on the other hand, are subject to a $25 fee.

5. SoFi

This is a full-service financial company that combines loan, banking, and investing into a single app. SoFi Invest, SoFi’s program for beginners, contains financial courses and lets you start small with partial shares called Stock Bits.

If you’re new to personal investing and want to learn as much as possible, SoFi could be the ideal investment app for you.

They provide personal financial planning and investing advice. To utilize this financial app, you don’t need a lot of money because SoFi has a $1 minimum deposit and no fees for online stock or ETF trading.

I appreciate that you can buy fractional shares, which means you can receive more stock options for a lower price. They provide a wide choice of low-cost investments as well as free management.

They’re ideal if you want to be a hands-off investor while still knowing your money is growing, or if you want to learn more about finance.

SoFi investors can choose from a variety of portfolios based on their risk tolerance. SoFi can assist you in determining your investment goals, such as whether you want to take a big risk for a quick profit or prefer a more secure long-term investment growth.

You can bank with SoFi in a variety of ways, in addition to the obvious advantages of appropriate investing and saving. SoFi Invest is a good solution for investors who wish to consolidate their finances.

Pros

- You can call real financial advisors working with SoFi for free if you need assistance or have a query

- ETFs and free stocks

- It only costs $1 to open the SoFi tool, making it available to everyone

- Account creation is quick and completely digital

- SoFi doesn’t charge you anything to manage your account.

Cons

- They have a limited product range

- Only has basic research components

- No tax-loss harvesting, a sophisticated investing strategy in which you sell a stock or mutual fund at a loss to gain a tax benefit

- Only available to clients in the United States

Pricing

SoFi is a platform for first-time investors. They have a no-commission policy that will get you started on your investment adventure right away.

There are a few occasions where fees apply, such as the 1.25% commission cost for cryptocurrency trading or the $15 fee for insufficient funds.

However, if you choose wisely which areas to invest in, you can accomplish all of your tradings with SoFi without incurring any fees.

6. Webull

Webull is a digital brokerage service that offers trading platforms for PC, mobile, and the web. It allows you to buy and sell stocks, exchange-traded funds (ETFs), and options for free with no commissions. Before any of the major investment firms got involved, this platform was available for free.

When it comes to attracting younger users with free services, they’re currently the largest competition to Robinhood.

Webull began as a research organization and only lately expanded into the brokerage business. This puts them ahead of Robinhood in terms of research and analytics, which are Robinhood’s weakest points.

Personal brokerage accounts and IRAs are available with this investment application. They can trade options, stocks, ETFs, and cryptocurrency. The broker allows for complete extended trading hours, including pre-market and after-market trading.

Sophisticated charts and technical indicators are available on Webull’s platform to assist users in analyzing firms and trends.

It has a very simple UI that makes it very easy to use. Given that minimalism may not appeal to everyone, I must point out that adding any more features to its layout would make it far too confusing, even for a seasoned user.

One of the major reasons why I placed Webull last on this list of the best investing apps for beginners is simply because it has a lot of charts and graphs, which can be confusing for someone who hasn’t done much investing before. However, with some helpful tips, the problem might be quickly solved.

When you open a Webull brokerage account, you’ll receive a free stock worth between $3 and $300. That isn’t all, though. You’ll get one more stock with a higher value (between $8 and $2,000) if you deposit at least $100.

Pros

- ETFs, stocks, and options are all available for free

- There is no minimum deposit

- Exceptional trading platforms

- Margin accounts and cryptocurrencies are both available

- Account creation is quick and simple

Cons

- Webull only accepts bank transfers for deposits and withdrawals

- They only have limited product range

- There is no live chat and the phone help is inadequate

Pricing

Most investment portals are free to use, but the platform charges trading and per-contract fees. Webull doesn’t charge any commissions; you won’t have to pay anything. Payments for interest credit balances, order flow, margin interest, and stock loans are how Webull makes money.

Due to lack of commissions, I’m confident in recommending Webull as one of the best investment apps for undergraduates, particularly those who are paying their way through school and thus possess limited cash. If you’re a student, learn here’s how to make money as a college student.

Certain regulatory authorities will charge you fees if you use the app. Webull, on the other hand, does not profit from the charges.

FAQs

1. What exactly is a robo-advisor?

A robo-advisor is an automated financial advisor. Robotic investing is a term used to describe the process of investing by robots.

Robo-advisors, on the other hand, are sophisticated computer algorithm that makes financial recommendations for you based on specific data. These algorithms are extremely sophisticated and have improved over time.

They design and manage your investment portfolio using computer algorithms and smart software at a fraction of the cost of a human financial advisor. Robos are ideal for investors who want to delegate portfolio management to a third party.

2. Is it safe to use investment apps?

Yes.

To secure your information, investment apps employ many layers of security, including two-factor authentication, personal data encryption, and regular hacking checks.

Your money is usually protected from criminal agents if you use a robust, distinct password that isn’t shared with another account or website.

When you’re away from home, avoid accessing your investment applications on public Wi-Fi networks like those found in coffee shops, businesses, hotels, and other public places.

Your secure mobile network should preserve your information safe when you’re away from home. Consider installing a VPN on your device as an added layer of protection.

SEE: Best VPN Providers: Protect Your Online Privacy

3. How much should I budget for my investment?

The good news for today’s investors is that they only need a small amount of money to get started. You can start with almost any amount of money because the fees are so low or even non-existent.

In reality, what you start with is less important than your long-term saving and investment discipline. The key to long-term investment success is to increase money regularly.

To create wealth, you’ll want to contribute money to the account and continue to invest in your positions regularly.

Your financial condition and requirements determine how much to invest. And today’s low-fee brokerages and apps allow you to invest with more money in your pocket.

See Also: How to Make Money with Day Trading: 8 Simple Day Trading Strategies

Conclusion

That concludes our list of the best investment apps currently on the market. Trying to figure out which is the ideal app for you will be entirely dependent on your requirements.

Acorns is the best investment app in my opinion. It includes some excellent investment methods for both novice and seasoned investors.

Webull is my top option for students searching for a means to invest some extra money that they’ve accumulated.

Are you a goal-oriented person? M1 Finance is the place to go. This investment tool assists with saving and investing for a certain aim.

Tosinajy teaches you how to make money online, the software you’ll need, and how to deal with common Internet issues.

Thanks for reading.

Ready to Join Acorns?

Click the button below to start saving and investing with Acorns.